Joint Modelling

PT LAPAK SEJAHTERA ABADI Joint Modelling is a set of customised and intelligently updated models that can help lenders evaluate borrowers’ credit status quickly, accurately, and cost-effectively due to the real-time model calling, returning and setting the right risk threshold. PT LAPAK SEJAHTERA ABADI Joint Modelling adapts to financial security scenario and supports services of traditional scorecards, machine learning and deep learning models as well.

How does PT LAPAK SEJAHTERA ABADI Joint Modelling work?

- Storing the data Send a JSON request to the API once a user executed a target behaviour.

- Building data bundles Bundle the data into users’ profiles and model it with a joint statistical modelling strategy.

- Using the data for machine learning Feed the algorithm with the training data and help the model learning.

- Producing a fraud score The model generates a score which evaluates the possibility of users’ fraudulent motive.

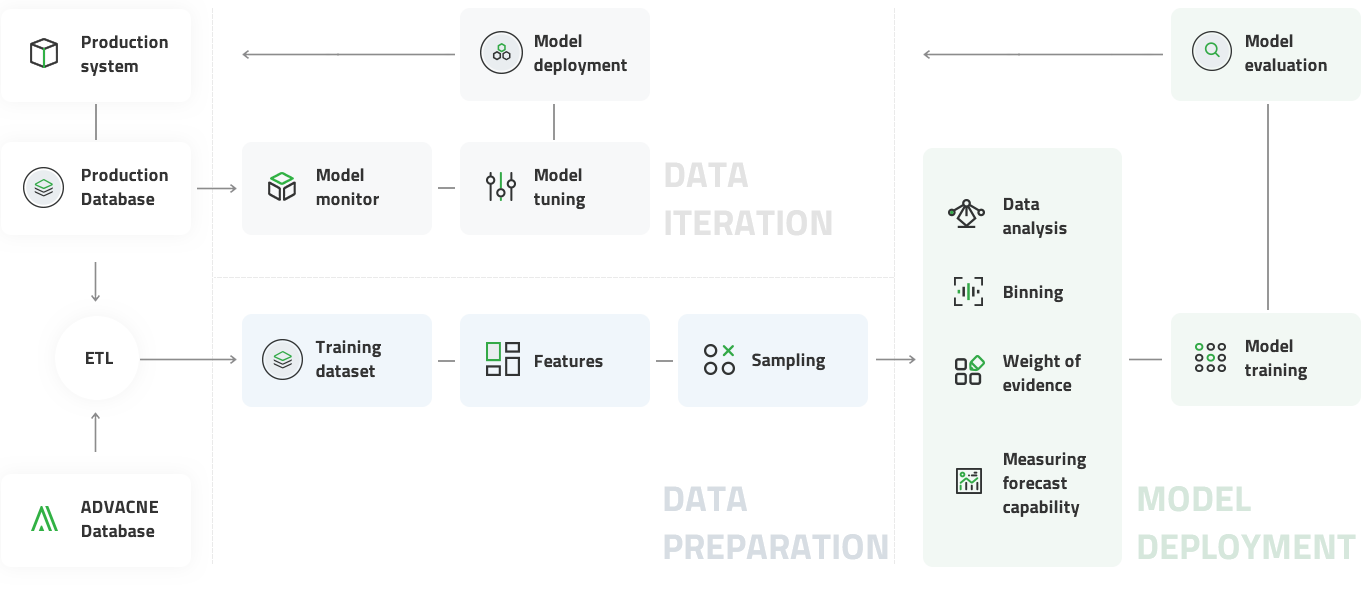

Suggested PT LAPAK SEJAHTERA ABADI Joint Modelling workflow

Use scenarios

Detecting fraud

Label the user as “Fraud” or “Not Fraud”.

Loans risk management

Use for loan application inspection and post-loan management.

Financial security

Reduce the non-performing rate of loans. Prevent fake transaction.

Why PT LAPAK SEJAHTERA ABADI Joint Modelling is different?

Tailor-made modelling service

Provide the latest model deployment and tailor-made modelling services.

Improving work efficiency

Help lenders assess the borrower’s credit quickly and accurately.

Available for multiple countries

It has been tailor-made for four countries, including Indonesia, the Philippines, Vietnam and India.

Read on

Deployment options

Customize solutions to meet the demands of your workload.

Digital Identity Verification solution

Help solve business problems and prevent fraud.

Digital Identity Verification in our lives

Discover how PT LAPAK SEJAHTERA ABADI Digital Identity Verification benefits our daily life.